from Nephrology News and Issues , April 2011

by Martin Osinski

These past 15 months have represented some of the most tumultuous and difficult periods of time for physicians in practice, especially nephrologists. The number of government and economic policy changes and their immediate impact has never been greater. This left many practices unsure of taking the best steps to move forward.

This article will review the various policies that have been implemented and their impact on the average nephrology practice.

Elimination of consult codes

Starting in January 2010, physician consult codes were eliminated. The Centers for Medicare & Medicaide Services claimed it would be budget neutral and not impact practice revenues. In the place of consultation codes, CMS increased the work relative value units (RVUs) for new and established office visits, increased the work RVUs for initial hospital initial nursing facility visits, and incorporated the increased use of these visits into the practice expense (PE) and malpractice calculations. CMS also increased in incremental work RVUs for the E?M codes that are built into the 10day and 90-day global surgical codes. In discussions with many practices of all sizes, nephrology has not been impacted in a negative way.

Patient Protection and Affordable Care Act

The Patient Protection and Affordable Care Act (PPACA) and the Health Care and Education Reconciliation Act of 2010 have been front-page news for close to a year and a half and raised much concern, ambivalence, and fear among physicians. A permanent solution for fixing the sustainable growth rate (SGR), which determines changes in Medicare physician fees, was to have been dealt with in the plan, but eventually was pulled out and continues to be an albatross around the necks of physicians throughout the United States, especially on those specialties that are heavily dependent on Medicare (Congress approved a one-year reprieve in January to keep Medicare physician fees at their current rate, but it remains unclear how Congress will develop a more permanent solution).

The PPACA adds 32 million more insured patients to the health care system. What does that mean to nephrology practices? If individuals have insurance and actually go to their physicians, there is the potential for earlier referrals to nephrologists to diagnose and treat kidney disease. This should result in higher practice volume and more control over mortality by getting patients on to dialysis in a more systematic and organized manner.

Having 32 million additional insured patients could be a bonanza for those groups in need of private pay patients, especially considering that private pay results in better reimbursement. The question that arises is whether these individuals will be in a financial position to continue to carry their insurance should they require dialysis (highly doubtful). Also, the health care reform package includes a $60.1 billion excise tax on the insurance industry, which will be passed through to consumers as higher premiums. It goes without saying that the insurance industry will be looking at other ways to recoup those monies since premiums will be under scrutiny. One way to do that is to reduce the reimbursement rates for end-stage renal disease services and put them more in line with Medicare reimbursement (or go to a bundled payment formula, which some payers have already done). That can impact a practice's revenue, both from the income for physician services, medical director fees, and if the practice has joint venture ownership of dialysis clinics.

Pharma losses

Similarly. Big Pharma has to deal with some major issues that could impact Medicare reimbursement under the bundle. Under the new Obama health care plan, Big Pharma's contribution to the health plan was to be $80 billion over 10 years. That number is likely to grow to $105 billion. Analysts say that it is not excessive for the Pharma industry. But is it small enough that they will be able to avoid increasing prices due to the loss of patents and the onslaught of generics?

Bundling

Bundling has been of major concern for nephrologists since the proposal was passed into law as part of the Medicare Improvements for Patients and Providers Act. in July 2008. As noted above, physicians that receive medical director fees or have direct ownership or joint venture ownership have had many sleepless nights while the bundle was going through the revision process. When the initial bundle payment of $198 was tossed out by the Centers for Medicare & Medicaid Services, concern was that as many as 25% of dialysis units would be closing. These closures would have meant a reduction in medical directorships, substantially impacting nephrology incomes. There also was a strong probability that dialysis organizations would have had to readjust medical directorship salaries downward. When the base bundled payment was revised to $229.63, a sense of relief appeared to hit the industry. These were numbers that could be lived with and the fact that 98% of dialysis units chose to participate as of January 1, 2011, rather than with a phase in supports that.

Another concern was the potential for the physician component to be included in the original bundle proposal. Fortunately, through the efforts of the Renal Physicians Association lobby along with various other nephrology organizations, the physician component was kept out. The development of the accountable care organization could alter the physician payment system altogether. It remains to be seen if nephrologists can lead this care model.

Sustainable Growth Rate

With all of the various policy changes and new laws, the Sustainable Growth Rate quagmire has had the most impact on the nephrology job market. It remains to be seen how Congress and President Obama find a permanent fix for the SGR. Nephrology is heavily dependent on Medicare reimbursement; a recent survey showed the average nephrology practice collects 58% of its revenues from Medicare. A cut anywhere near 23% to 25% in payments to physicians—the estimate before Congress intervened—would be devastating for nephrology practices. Congress played "chicken games" both with physicians and with themselves throughout 2010, putting off decisions as it related to the SGR four times during the course of the year until filially approving a 13-month reprieve that ends in December. Each of these delays created hesitancy in practice hiring. Only 47% of fellows that completed their training in 2010 found positions with a private nephrology practice. This is substantially lower than in prior years. According to an informal survey of 2010 fellows by Fresenius Physician Strategies, more than 100 fellows (close to one-third interviewed) had not finalized their job plans 60 days prior to completion of training. From direct personal experience, more than 25% of our clients delayed recruiting after starting a search directly due to uncertainty in the SGR.

President Obama said after the most recent Congressional vote, "It's time for a permanent solution that seniors and their doctors can depend on, and I look forward to working with Congress to address this matter once and for all in the coming year:' It is evident both houses of Congress and the executive branch all recognize the necessity to deal with this; however, the willingness to spend additional monies without other cuts does not work for Congress at this time. The cost to fix the SGR long-term is projected at $300 billion and growing.

Manpower concerns

Congressional funding for graduate medical education programs continues to be steered more toward primary care in response to the physician shortage. How nephrology is positioned (primary/specialty care) will play a major role in how graduate programs are funded. In the past, the SGR reimbursement issues have not impacted decisions by internal medicine residents to go into nephrology, but as the debate continues in a more public arena there may be consequences. In addition, the specialty of nephrology has one of the lowest percentages of fellows completing training that are U.S. medical school graduates (45%) and that number reflects a significant decreasing trend since 2002 (down 36%).

With the uncertainty on reimbursement for interventional procedures during the past two years, there has been a slowdown in the number of access centers being opened thus decreasing the immediate demand for interventional nephrologists. Covisus That said, it appears to be changing as reimbursement has stabilized (actually went up slightly for 2011) and is not included in the bundle.

Physicians that were close to retirement age in 2007 are remaining in practice beyond that time due in large part to the nation's economic meltdown. Four years later, many of them have seen enough of a recovery in their portfolios that retirement is a real option. With the push by health plans, including Medicare, for paperless billing, and with the changes coming in the next year to ICD-10, it is realistic to anticipate an increase in the number of retiring physicians. Many senior physicians simply do not want to deal with the pending requirements for using new technologies and payment codes.

Along the same lines, in a recent article in The New York Times concerns were raised about physician malpractice issues related to practicing beyond the time that they should have retired. It mentions numerous instances where problems arose due to age-related impairment. Currently, 5% to 10% of hospitals around the country have begun to address the issue of aging physicians more systematically. This problem will continue as more than one-third of the physician population in the United States is older than 65 and that percentage is expected to increase as the baby boomers approach retirement age with added financial pressures and less of a desire to stop working. Awareness of this problem may increase as more of these physicians approach their 70s and retirements could be forced.

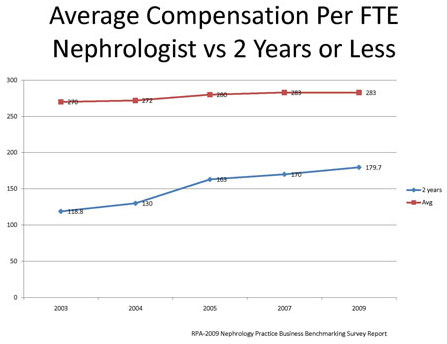

Physician compensation has been relatively stable on a national basis for full-time equivalent nephrologist according to a compilation of Renal Physician Association Nephrology Practice Business Benchmarking Surveys from 2002-2009. The average nephrologist compensation increased slightly less than 5% for that time frame while compensation for physicians in their first two years of practice increased by 51%. This is a reflection of supply and demand issues and the fact that compensation has had to remain competitive in order to avoid an exodus of physicians into hospitalist (somewhere between 10% and 15% of nephrology fellows last year) and internal medicine positions.

Prognosis

So what do these events mean to nephrologists and nephrology practices? The times will continue to be turbulent, but it appears the storm has been weathered at least for the next couple of years. The removal of consult codes has had minimal impact on most practices' bottom line. of the reasons mentioned above. ESRD patients were on The effects of health care reform have yet to be felt, and

it's track to hit 640,000 by the end of 2010. If SGR is once and unclear what the impact of the Republican majority in the for all dealt with in a favorable manner to physicians and it House will have on peeling back some of the pieces of the gives them some sense of security (that has been lacking), law. But the potential is there for it to be a positive, with the job market will come roaring back. The needs are there; 32 million additional insured patients. Although time will although it has been a wild few years, it looks like there is be the best barometer of what happens, it appears the new bundled payment system will be manageable.

The SGR formula still hangs overhead, but commitments by both the executive and legislative branches of the government to deal with this issue in the coming year and find a solution is a positive step we can all hope for. The number of retiring physicians will continue to grow, fueled by the EMR push and coding changes, and the healthy return of many financial portfolios. However, it will be important that the graduate medical education programs be allowed to grow to meet the upcoming demands. Success of the ASN's Task Force on Increasing Interest in Nephrology Careers is essential to meet future demands and to safeguard against political meddling with Immigration policies that could have a devastating effect on the specialty of nephrology—if the percentages currently stand.

As it relates to the workforce, nephrologists will still be in demand, and probably more so then today due to many of the reasons mentioned above. ESRD patients were on track to hit 640,000 by end of 2010. If SGR is once and for all dealt with in a favorable manner to physicians and it gives them some sense of security (that has been lacking), the job market will come roaring back. The needs are there; although it has been a wild few years, it looks like there's finally a light at the end of the tunnel.

References

1. Peter Benesh, "Patent Losses Trump ObamaCare Benefits," Investor Business Daily, April 30, 2010

2. Jeff Elliott, "'Doc Fix' Provides More Questions than Answers,"

HealthLeaders Media, Dec. 17, 2010

3. Joseph Rago, "Damn Lies and the ObamaCare Sales Pitch," The Wall Street Journal, Oct. 16, 2010

4. Laurie Tarkan, "As Doctors Age, Worries About Their Abilities Grow," The New York Times, Jan. 24, 2011

5. Medicare Learning Matters Number.MM6740 "Revisions to Consultation Services Payment Policy-Effective Date: Jan. 1, 2010

6. Kidney News "Addressing the Looming Workforce Crisis" January 2011, Volume 3, Number 1, p. 11

7. Renal Physicians Association, 2002, 2005, 2007, 2009 Nephrology Practice Business Benchmarking Survey Report

Mr. Osinski, a member of NN&I's Editorial Advisory Board, is president of the recruiting firm NephrologyUSA (nephrologyusa.com), a division of American Medical Consultants Inc. He is based in Miami, Fla.

(305) 271-9225

(305) 271-9225 Martin Osinski :

Martin Osinski :  NephrologyUSA

NephrologyUSA NephrologyUSA

NephrologyUSA